So, you have made the decision to find a new home. WHAT NOW?

Every conversation I have with you is held in the strictest of confidence. I will use this information to ensure you, my client, get the best home at the best price possible. I am here to serve you, wholly and completely. I’m not satisfied until you are, and I will do everything humanly possible to ensure you are 110% satisfied with the service I provide.

Have you already found your dream property online? I would be more than happy to show it to you! As a licensed real estate agent in Prince Edward Island, I have the ability to show and sell any property on the Island, regardless of which company has their sign at the road.

As a client of Steve Nabuurs, you can expect timely responses to any and all inquiries, open and honest conversations, complete confidence that I will give you the best service on PEI.

Remember, I am not happy until you are!

The Right Neighbourhood

Location is one of the single most important factors. It will help to narrow your search and focus on the homes that will suit you and your family’s needs.

There are many factors in choosing the right neighbourhood or community. Here is a list of six questions that will help you narrow it down to the area that is best for you!

- How far is it to schools, work, entertainment, extracurricular, grocery? Is it walking distance or car dependant?

- Is it close enough that I can reduce the use of my car, thereby saving money on gas and maintenance?

- What will my mortgage, heat, and taxes be per month, in this area?

- Is the size of the home suitable? Are there enough bed and bathrooms?

- Is the land size suitable?

The Mortgage

To determine, more closely, what you can afford per month, you will need the following information:

- Annual income

- Monthly debt payments

- Annual property tax

- Condo fee / Land rental

- Monthly heating costs

Follow this link and you can use the above listed information to determine an approximate monthly mortgage payment. http://www.howrealtorshelp.ca/mortgage-calculator.php

Mortgage Pre-Approval

vs.

Approved Mortgage

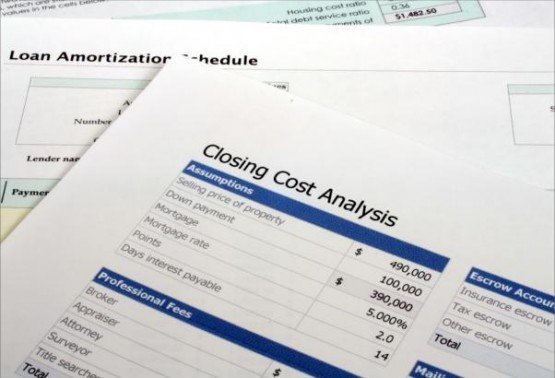

Closing Costs

This amount will be in addition to your down payment and will be payable to your lawyer who will distribute the funds accordingly. When budgeting, it is a good idea to expect 1%-4% of the purchase price will be needed for closing costs.